Industry News & Trends

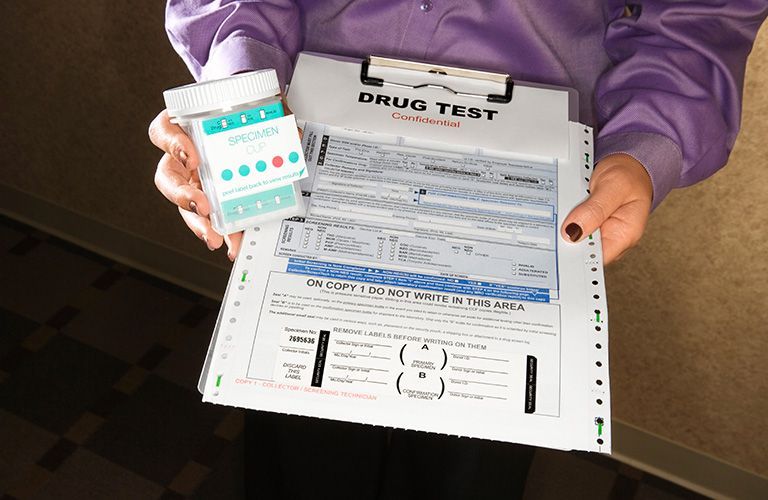

Drug testing in the workplace is a practice that has gained significant attention in recent years. It involves screening employees for the use of illicit substances and, in some cases, the abuse of prescription medications. While there are arguments against workplace drug testing, it undeniably offers numerous benefits to both employers and employees. In this blog post, we will explore the advantages of employee drug testing programs and why you should implement one for your business. Safety and Productivity One of the most compelling reasons for drug testing in the workplace is the enhancement of safety and productivity. Employees under the influence of drugs or alcohol are more likely to cause accidents, make errors, and exhibit impaired judgment. Drug testing helps identify individuals with substance abuse issues, preventing them from putting themselves and their colleagues at risk. A safer workplace leads to increased productivity, as employees can focus on their tasks without worrying about the consequences of impaired coworkers. Legal Compliance Many industries and government contracts require drug testing as part of compliance with specific regulations. By implementing drug testing, employers can ensure they meet these legal requirements, avoiding potential fines or the loss of contracts. This legal compliance also extends to workers' compensation claims, where having a drug-free workplace can be essential in demonstrating that accidents were not caused by substance abuse. Reduction of Healthcare Costs Drug testing can contribute to reducing healthcare costs. Employees struggling with substance abuse issues often require more medical attention due to the health problems associated with drug and alcohol use. Identifying these individuals early on and offering support and treatment can lead to healthier employees, lower healthcare expenses, and a reduced burden on insurance premiums. Reduce Legal Liability The U.S. Department of Labor estimates that drug use by employees cost businesses billions of dollars annually as a result of workplace accidents. The implementation of a drug testing policy can assist your business in reducing these costs by lowering your risks and liability. Improved Employee Morale A workplace free from substance abuse concerns can boost employee morale. When employees know their colleagues are not abusing drugs or alcohol, they are more likely to feel safe, respected, and motivated. This can lead to increased job satisfaction and a more positive work environment, ultimately reducing turnover rates. Enhanced Company Reputation Employers that invest in drug testing programs demonstrate a commitment to a safe and responsible workplace. This commitment can enhance a company's reputation, making it more attractive to potential employees, customers, and partners. A strong reputation for maintaining a drug-free environment can differentiate a company in a competitive marketplace. Early Intervention Drug testing not only identifies employees with substance abuse issues but also offers an opportunity for early intervention. Employers can connect these individuals with resources, such as Employee Assistance Programs (EAPs), counseling, and treatment options. Early intervention can prevent the escalation of substance abuse problems and help employees overcome their issues, ultimately preserving their careers. Deterrence The knowledge that random drug testing is in place can act as a deterrent for employees who may consider using drugs or alcohol inappropriately. The fear of testing positive can discourage substance abuse and create a culture of accountability within the workplace. In conclusion, when administered fairly and with respect for employees' rights, drug testing can be a valuable tool in promoting a healthier and more prosperous workplace. Ultimately, the benefits of workplace drug testing outweigh the potential drawbacks, leading to safer, more productive, and more successful organizations. At CourtHouse Concepts, we can provide and manage pre-employment drug screening and set up random drug testing for your company. Call us today for a custom proposal!

Employment Background Screening in the Banking Industry: Striking a Balance Between Trust & Security

In the ever-evolving landscape of the banking industry, maintaining the delicate equilibrium between trust and security is paramount. One of the tools financial institutions employ to uphold this equilibrium is employment background screening. This rigorous process serves as a shield against potential risks while ensuring that qualified individuals are entrusted with the responsibility of managing crucial financial matters. As technology advances and regulations become more stringent, understanding the nuances of employment background screening in the banking sector is of utmost importance. The Significance of Employment Background Screening The banking industry operates at the heart of economic activities, managing vast amounts of money, sensitive financial data, and playing a pivotal role in maintaining overall economic stability. Given this profound responsibility, hiring individuals of impeccable character, competence, and integrity is non-negotiable. Employment background screening is the mechanism by which financial institutions verify the credentials, criminal history, creditworthiness, and overall suitability of potential employees. Key Components of Background Screening Criminal History Check: A thorough criminal history check is essential to ensure that individuals with a history of financial fraud, embezzlement, or other criminal activities are not placed in positions of financial authority. Credit History Analysis: Given the financial nature of the banking industry, assessing an applicant's credit history can provide insights into their financial responsibility and stability. However, it's important to note that a poor credit history alone should not be the sole reason for disqualification, as certain circumstances may lead to temporary financial challenges. Employment and Education Verification: Confirming an applicant's past employment and educational qualifications helps prevent fraudulent claims on resumes. This verification ensures that candidates possess the skills and experience they claim to have. Reference Checks: Speaking with previous employers and references offers a holistic view of an applicant's work ethic, interpersonal skills, and overall performance. This step can provide valuable insights beyond what's mentioned on a resume. Regulatory Compliance: The banking industry is heavily regulated, and financial institutions must ensure that their employees meet regulatory standards. Background checks help identify individuals who might be disqualified due to regulatory or legal reasons. Navigating Challenges and Considerations While employment background screening is a critical tool, it's not without challenges and ethical considerations. Balancing Privacy and Security: Striking a balance between obtaining necessary information and respecting an applicant's privacy rights is delicate. Financial institutions must ensure that they comply with applicable data protection laws. Mitigating Unconscious Bias: Human bias can inadvertently seep into the screening process, potentially leading to unfair discrimination. Developing standardized screening criteria and ensuring all applicants are treated equally is vital. Accounting for Rehabilitation: A criminal record shouldn't always be an absolute barrier to employment. Individuals who have demonstrated rehabilitation and growth should be given a chance to reintegrate into society. Technological Advancements: The rise of AI and automation has introduced new tools for background screening. However, relying solely on algorithms could lead to oversights, emphasizing the importance of human judgment in the process. Conclusion In the banking industry, employment background screening is a safeguard that upholds trust and security. It's a comprehensive process that involves scrutinizing an applicant's criminal history, creditworthiness, employment and educational background, and references. This careful evaluation helps financial institutions make informed decisions about potential employees who will handle significant financial responsibilities. However, it's crucial to navigate the challenges of privacy, bias, and technological reliance. As the industry continues to evolve, striking the right balance between a rigorous screening process and ethical considerations will be vital. Ultimately, employment background screening is a cornerstone of the banking industry's commitment to maintaining trust, security, and integrity in all its operations. At CourtHouse Concepts, we help employers define, understand and manage hiring risks, adding simplicity and confidence to your hiring process. Give us a call today, to get a quote or schedule a consultation.

When it's the last year of your 50's, you deserve your own blog post on your birthday. We want to wish a very happy birthday to our Director of Drug & Alcohol Testing Services, Gary Graves! Gary's been with CHC over 9 years and we appreciate all he has done for the organization. He also heads our Live Scan digital fingerprinting services as well, so he wears many hats for us. Thank you, Gary!